Picture this: You’re at a fancy restaurant, candlelight flickering, soft music playing in the background. Across the table sits the home of your dreams, looking absolutely stunning. You’re ready to pop the big question: “Will you be my forever home?” But wait! Before you get down on one knee with that hefty down payment, there’s a third wheel on this date you can’t ignore – Interest Rates.

Yes, folks, in the wild world of real estate, interest rates are like that friend who insists on chaperoning your romantic evenings. They’re always there, influencing your decisions, sometimes helping, sometimes… well, let’s just say they can be a bit of a mood killer.

But why, oh why, are these numeric chaperones so crucial in our real estate love stories? Let me break it down for you:

1. Affordability: Lower rates are like a generous friend spotting you some cash. Suddenly, that dream home doesn’t cost an arm, a leg, and your favorite coffee mug.

2. Buying Power: With the right interest rate, you might go from window shopping for a cozy cottage to strutting into a palatial manor. It’s like getting a surprise upgrade from coach to first class, but for your living situation.

3. Market Mood Swings: Interest rates can turn the real estate market into a wild party or a ghost town faster than you can say “adjustable-rate mortgage.”

4. Property Value Tango: Over time, these rates do a complicated dance with property values. It’s like watching a never-ending episode of “Dancing with the Stars,” but with more zeroes involved.

As we dive deeper into this financial soap opera, we’ll explore how the current interest rate trends are shaping our real estate landscape. Whether you’re a first-time homebuyer, a seasoned property tycoon, or just someone who enjoys a good real estate reality show, understanding the role of interest rates will give you the inside scoop.

So, grab your calculators (or let’s be honest, your smartphone apps), and let’s embark on this thrilling journey through the world of real estate and its clingy companion, the ever-present interest rate. Trust me, by the end of this, you’ll be the life of any housewarming party with your savvy interest rate banter!

Current Interest Rate Trends in the Real Estate Market –money.com

As of October 2024, the real estate market continues to be influenced by a complex interplay of economic factors affecting interest rates. Here are the key trends we’re observing:

Federal Reserve Policy: The Federal Reserve has maintained a cautious approach to interest rate management, balancing the need to control inflation with supporting economic growth. Their decisions continue to have a significant impact on mortgage rates.

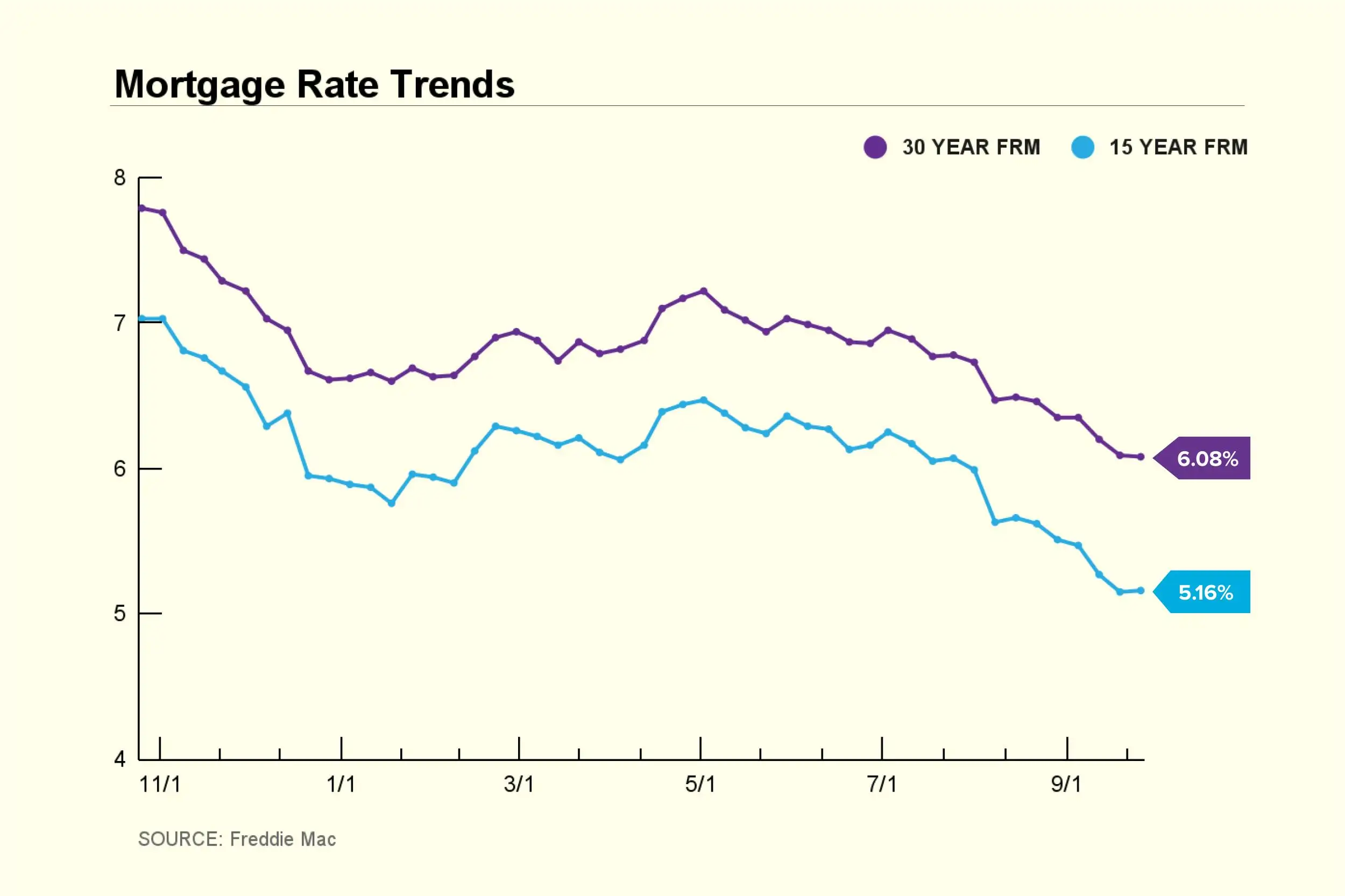

Mortgage Rate Overview:

– 30-year fixed-rate mortgages are averaging around 6.08%

– 15-year fixed-rate mortgages are at approximately 5.16%

Understanding these current trends provides valuable context for both buyers and sellers in today’s real estate market. In the following sections, we’ll explore how these trends are specifically impacting various players in the real estate sector.

How Interest Rates Affect Home Buyers

Interest rates play a pivotal role in shaping the home buying experience. Here’s how they impact potential buyers:

- AFFORDABILITY

– Lower interest rates mean lower monthly mortgage payments, making homeownership more accessible.

– Even a 1% difference in interest rates can significantly change the long-term cost of a home. - BUYING POWER

– With lower rates, buyers can often afford more expensive homes while keeping monthly payments manageable.

– Example: A 1% decrease in interest rate could increase buying power by approximately 10%. - QUALIFICATIONS FOR LOANS

– Lower rates may help more buyers qualify for mortgages, as debt-to-income ratios improve with lower monthly payments. - TYPE OF MORTGAGE

– Interest rates influence the choice between fixed-rate and adjustable-rate mortgages (ARMs).

– In a low-rate environment, fixed-rate mortgages become more attractive for long-term stability. - TIMING THE M MARKET

– Buyers often try to time their purchase with favorable rates, which can lead to increased competition in low-rate periods. - DOWN PAYMENT CONSIDERATIONS

– Lower rates might allow some buyers to put less money down while keeping payments affordable, helping with the initial hurdle of homeownership. - LONG-TERM FINANCIAL PLANNING

– The interest rate secured at purchase has long-lasting effects on a buyer’s financial future, influencing everything from investment strategies to retirement planning. - REFINANCING POTENTIAL

– Buyers who purchase when rates are high may have future opportunities to refinance if rates drop, but this comes with its own costs and considerations.

For potential home buyers, it’s crucial to:

– Stay informed about current rates and trends.

– Get pre-approved to understand your buying power.

– Consider the long-term implications of your interest rate, not just the immediate affordability.

– Work with a knowledgeable real estate agent and mortgage professional to navigate the market effectively.

Remember, while interest rates are important, they shouldn’t be the only factor in your home buying decision. The right time to buy is when it aligns with your personal and financial goals.

Impact of Interest Rates on Sellers and the Overall Real Estate Market

While buyers are directly affected by interest rates through mortgage costs, sellers and the broader market also experience significant impacts:

- HOME PRICES

– Lower interest rates often lead to increased demand, potentially driving up home prices.

– Higher rates can cool demand, possibly leading to price stagnation or even decreases in some markets. - TIME ON MARKET

– In a low-rate environment, homes typically sell faster due to increased buyer activity.

– Higher rates may extend the average time homes spend on the market. - SELLER’S MARKET VS. BUYER’S MARKET

– Low rates tend to create a seller’s market with multiple offers and competitive bidding.

– Higher rates can shift the balance towards a buyer’s market, giving purchasers more negotiating power. - INVENTORY LEVELS

– Low rates may decrease inventory as homeowners are reluctant to sell and lose their favorable mortgage terms.

– This “lock-in effect” can create a shortage of homes for sale, further driving up prices. - SELLER STRATEGIES

– In a high-rate environment, sellers might offer concessions or seller financing to attract buyers.

– When rates are low, sellers may be able to command premium prices for their properties. - MARKET ACTIVITY

– Lower rates generally increase overall market activity, with more transactions taking place.

– Higher rates can slow down the market, reducing the number of both buyers and sellers. - PROPERTY TYPES

– Interest rates can affect different property types differently. For example, investment properties might be more sensitive to rate changes than primary residences. - REFINANCING IMPACTS

– Low rates increase refinancing activity, which doesn’t directly impact home sales but affects overall market dynamics and property values. - NEW CONSTRUCTION

– Interest rates influence the cost of construction loans, affecting the supply of new homes entering the market. - LONG-TERM MARKET HEALTH

– While low rates can stimulate the market, extremely low rates for extended periods can lead to unsustainable price growth and potential market corrections.

For sellers, it’s important to:

– Understand how current interest rates are affecting your local market.

– Price your home appropriately considering the interest rate environment.

– Be prepared to adjust your selling strategy based on market conditions influenced by rates.

– Consider the impact of rates on your own future purchase if you’re planning to buy after selling.

Remember, while interest rates are a significant factor, local market conditions, economic trends, and individual property characteristics also play crucial roles in the real estate market dynamics.

Predictions for Future Interest Rate Movements

Forecasting interest rate trends is a complex task influenced by numerous economic factors. While it’s impossible to predict with certainty, here are some key considerations and expert opinions on the future direction of interest rates:

ECONOMIC INDICATORS

– Inflation rates

– Employment figures

– GDP growth

– Global economic conditions

These factors play a crucial role in the Federal Reserve’s decisions on interest rates.

FEDERAL RESERVE POLICIES

– The Fed’s current stance and future plans for monetary policy

– Any signals from Fed officials about potential rate changes

SHORT-TERM OUTLOOK

-Many economists expect rates to remain relatively stable with potential for slight increases/decreases.

LONG-TERM PROJECTIONS(1-5 years):

– Some analysts predict a gradual rise in rates over the next few years as the economy continues to recover and stabilize.

POTENTIAL INFLUENCING FACTORS

– Geopolitical events

– Technological advancements

– Changes in government policies

– Unforeseen economic shocks

IMPACT ON CLIMATE CHANGE

– Increasing focus on green investments and sustainable development may influence future interest rate policies

DEOMOGRAPHIC SHIFTS

– Aging populations in many developed countries could impact long-term interest rate trends

MARKET EXPECTATIONS

– How financial markets are pricing future interest rates, which can be gleaned from bond yields and other financial instruments

These are predictions and should be taken as educated guesses rather than certainties. It’s crucial for readers to:

– Stay informed about economic news and trends

– Consult with financial advisors for personalized advice

– Be prepared for various scenarios when making real estate decisions

– Understand that even experts can be wrong, and unexpected events can quickly change the interest rate landscape

By staying informed and flexible, both buyers and sellers can navigate the real estate market more effectively, regardless of how interest rates may change in the future.

Tips for Navigating the Real Estate Market in the Current Interest Rate Environment

Whether you’re a buyer, seller, or investor, understanding how to navigate the real estate market in light of current interest rates is crucial. Here are some practical tips to help you make informed decisions:

For Buyers:

1. Get pre-approved: Understand your buying power in the current rate environment.

2. Consider your long-term plans: Don’t let rates alone drive your decision to buy.

3. Explore different loan types: Fixed-rate vs. adjustable-rate mortgages may offer different advantages depending on your situation.

4. Improve your credit score: A better score can help you secure a lower interest rate.

5. Save for a larger down payment: This can help offset higher monthly payments due to interest rates.

6. Be prepared to act quickly: In a competitive market, being ready to make an offer can be crucial.

7. Consider buying points: Paying to lower your interest rate might make sense if you plan to stay in the home long-term.

For Sellers:

1. Price strategically: Understand how rates are affecting buyer demand in your area.

2. Highlight energy-efficient features: These can help offset higher mortgage costs for buyers.

3. Consider offering seller concessions: In a higher-rate environment, helping with closing costs could attract more buyers.

4. Be flexible with closing dates: This can help buyers who are trying to time their purchase with rate locks.

5. Prepare for longer selling times: Higher rates might mean fewer buyers, so patience may be necessary.

6. Stage your home effectively: Making your property stand out becomes even more important when buyers are being selective.

For Investors:

1. Reassess your investment strategy: Different types of properties may perform better in various rate environments.

2. Consider refinancing existing properties: If rates are favorable, this could improve your cash flow.

3. Look into value-add opportunities: Properties that can be improved may offer better returns in a higher-rate environment.

4. Stay informed about local market conditions: National trends don’t always reflect what’s happening in specific areas.

5. Network with real estate professionals: They can provide valuable insights into how rates are affecting your local market.

General Tips:

1. Stay informed: Keep up with economic news and how it might impact interest rates.

2. Work with experienced professionals: A knowledgeable real estate agent and mortgage broker can be invaluable.

3. Don’t try to time the market perfectly: Waiting for the “perfect” rate could mean missing out on opportunities.

4. Consider the whole financial picture: Interest rates are important, but they’re just one part of the equation.

5. Have a backup plan: Be prepared for how you’ll respond if rates change significantly during your buying or selling process.

Remember, the right moves in any market condition depend on your individual circumstances, goals, and risk tolerance. These tips provide a starting point, but it’s always wise to consult with financial and real estate professionals for advice tailored to your specific situation.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link